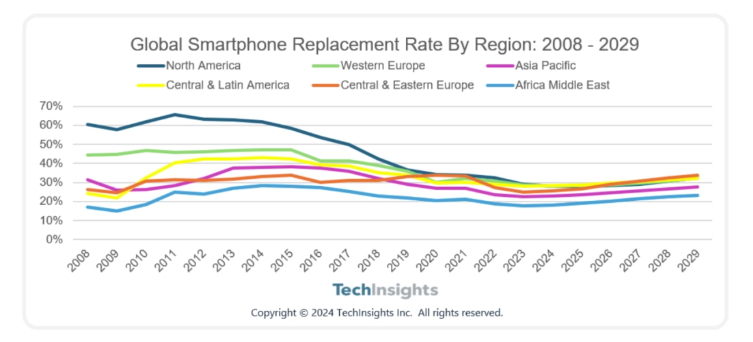

July 01, 2024 – Since the advent of the iPhone in 2007, North America has led the world in smartphone replacement rates. However, a notable decline has been observed since 2012, with rates finally leveling off in 2019 to match those of other regions.

According to recent research conducted by the TechInsights smartphone team, a significant shift is anticipated in 2024. Central America and Latin America (CALA) are poised to surpass North America with a replacement rate of 28.2%. Both regions share a similar replacement cycle of 43 months.

Globally, the replacement rate stands at 23.8%, equating to a 51-month cycle. Interestingly, Central and Eastern Europe are forecasted to take over the lead from CALA between 2027 and 2029.

TechInsights predicts that from 2025 to 2026, Central America and Latin America will maintain their high replacement rates, peaking at 28.8% and 29.6% respectively, corresponding to cycles of 42 and 41 months. However, a notable surge is expected in Central and Eastern Europe from 2027 onwards, with rates hitting 30.8% and potentially escalating to 33.8% – marking an all-time high in the region. This trend reflects the maturation of the smartphone market and the perceived lack of compelling new features.

Historically, North America’s replacement rates were unparalleled. Now, TechInsights anticipates a convergence with Western Europe, Central and Latin America, as well as Central and Eastern Europe. Several factors contribute to this trend. Within North America, the U.S., with a 27.7% replacement rate, significantly lags behind Canada’s 31.4%, driving down the regional average.

A primary reason for this shift in the U.S. is the gradual abandonment of the subsidy model by carriers since 2014/2015, transitioning to phone financing (known as EIP plans) and leasing models. Compared to subsidies, these new models often lock customers into three-year contracts instead of two and discourage upgrades upon contract completion due to lower monthly costs after the phone is paid off.

Additionally, improved smartphone quality and limited hardware innovations contribute to the extended replacement cycles in North America. A similar trend emerges in Western Europe, where, despite maintaining subsidy models, contract durations have often been extended to three years.