February 20, 2025 – Nikola Corp., the once-promising hydrogen electric truck startup, has filed for Chapter 11 bankruptcy protection on Wednesday, citing its inability to find a buyer or raise additional funds to sustain its operations.

Nikola, which was once a darling of Silicon Valley, saw its valuation soar to $30 billion after going public through a Special Purpose Acquisition Company (SPAC) merger in June 2020. However, a series of scandals involving its founder and former CEO Trevor Milton plunged the company into a crisis.

According to regulatory filings, Nikola plans to auction its assets pending court approval. In a statement, Steve Girsky, Nikola’s President and CEO, attributed the company’s difficulties to various market and macroeconomic factors that have undermined its operational capabilities. Despite several measures taken to raise funds, reduce liabilities, and preserve cash, the board determined that Chapter 11 protection was the best option for the company and its stakeholders.

Nikola currently has approximately $47 million in cash to support its bankruptcy proceedings. The proposed bidding process will allow interested parties to submit binding offers to acquire Nikola’s assets, which will be sold independently of the company’s debts or liabilities.

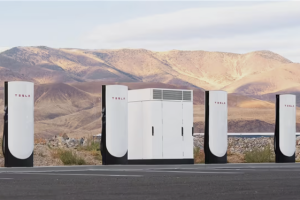

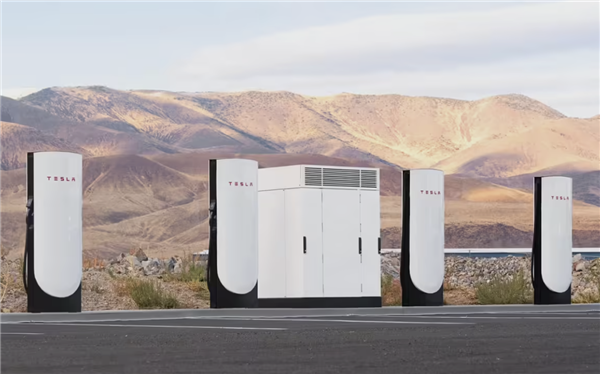

Among these assets are Nikola’s Class 8 hydrogen fuel cell and battery-electric truck platforms. The company had also planned to develop a hydrogen fueling highway called HYLA in California.

Nikola was once seen as a SPAC success story and had even secured a multibillion-dollar deal with General Motors. However, Milton’s alleged fraud related to the exaggeration of the company’s electric truck technology tarnished its reputation.

In the case against Milton, prosecutors allege that he deceived investors by falsely claiming that Nikola had developed its trucks and batteries from scratch, whereas they were actually purchased from other sources. A notorious Nikola marketing video showing a truck apparently moving under its own power, but later revealed to be just rolling downhill, further damaged the company’s credibility.

Following the video’s release, short-seller Hindenburg Research published a report accusing Nikola of fraud, leading to Milton’s resignation in September 2020. Milton was convicted of wire and securities fraud in 2022 and is currently appealing his four-year prison sentence while on bail.

Nikola eventually reached a settlement with the Securities and Exchange Commission (SEC), paying a $125 million fine. The company’s stock price plummeted, causing significant losses for investors and the company itself.

Since then, Nikola has struggled to raise sufficient funds to stay afloat. In December 2024, the company attempted to raise $100 million through a common stock sale to repay debts and increase its equity. Previously, during its third-quarter earnings call, Nikola warned investors that its cash would only support operations until the first quarter of 2025.

As of the end of the third quarter, Nikola reported $198 million in cash.