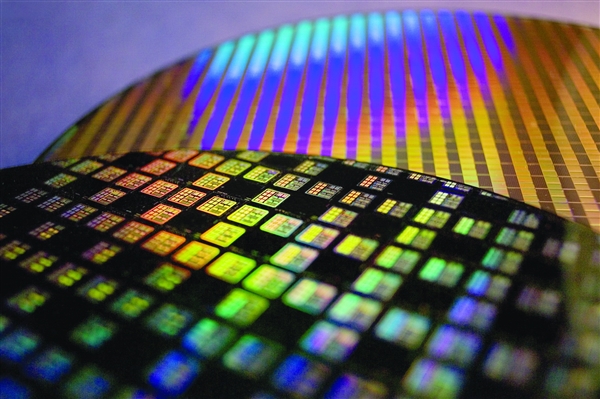

August 08, 2024 – Intel, the U.S. chipmaking giant, faced a class-action lawsuit from its shareholders on Wednesday, according to a report by Reuters. The plaintiffs accused the company of concealing significant operational issues, leading to poor performance, massive layoffs, and the suspension of dividends. Consequently, the company’s stock price evaporated more than $32 billion in a single day.

The lawsuit, which has been filed in the Federal Court in San Francisco, also named Intel’s CEO, Pat Gelsinger, and CFO, David Zinsner, as defendants.

Shareholders expressed that they were blindsided by Intel’s disclosure on August 1st that its foundry services business, which produces chips for other companies, was “in trouble.” They alleged that the company had made materially false or misleading statements about its business and manufacturing capabilities, artificially inflating its stock price between January 25th and August 1st.

Intel has not responded to these allegations.

Last Thursday, Intel announced layoffs affecting over 15% of its workforce, equivalent to 15,000 employees, and suspended dividend payments from the fourth quarter. The company aims to save 10billionincostsby2025throughrestructuring.Additionally,Intelreportedanetlossof1.61 billion in the second quarter, with revenue declining by 1% to $12.83 billion.

For a long time, Intel has struggled in the highly competitive chip market, finding it difficult to benefit from the artificial intelligence boom. Its primary competitors include AMD, NVIDIA, Samsung Electronics, and TSMC.

On August 2nd, the day after the company announced its quarterly results, layoffs, and dividend suspension, Intel’s stock price plummeted by 26% to 21.48.Thedeclinecontinued,andbyWednesday′sclose,thestockhadfallenby3.618.99, representing a 34.6% drop since the announcement.