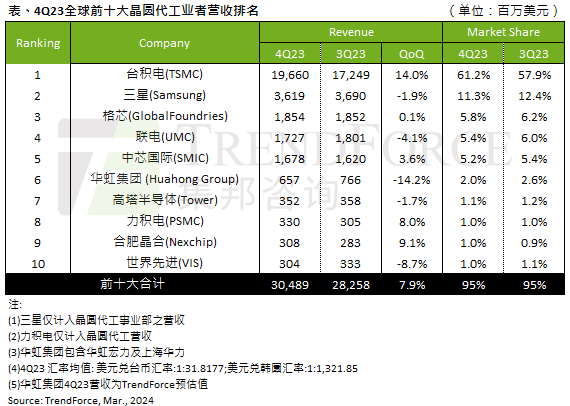

March 13, 2024 – According to the latest report released by TrendForce, a leading market research firm, the top ten wafer foundries globally generated a revenue of US$304.9 billion in the fourth quarter of 2023. Among them, SMIC secured the fifth spot while Hefei Nexchip re-entered the list at ninth place.

TSMC retained its top position with a 61.2% market share, generating a quarterly revenue of US$196.6 billion (approximately RMB 140 billion). Notably, its revenue from processes at 7nm and below accounted for 67% of the total. Driven by increasing demand from Apple, TSMC’s 3nm production capacity and wafer starts are ramping up quarter by quarter, and its revenue share from advanced processes is expected to surpass the 70% mark in the coming quarters.

Samsung ranked second in revenue but experienced a 1.9% decrease to US$36.2 billion. Although it received some orders for new smartphone components, most of them were for mature processes at 28nm and above.

GlobalFoundries came in third in terms of revenue. Benefiting from an increase in average selling prices, its revenue slightly increased by 0.1% to US$18.5 billion.

UMC ranked fourth but faced challenges due to the weak global economy, conservative customer wafer starts, and inventory adjustments among automotive customers. As a result, its wafer shipments declined in the fourth quarter, leading to a 4.1% decrease in revenue.

SMIC, ranked fifth, achieved a 3.6% increase in revenue to US$16.8 billion in the fourth quarter of 2023. This growth was primarily driven by urgent orders related to smartphones and PCs. However, its revenue from network communications, general consumer electronics, and automotive/industrial control businesses declined.

According to TrendForce, there were three significant changes among the sixth to tenth positions. Firstly, Powerchip Semiconductor Manufacturing Corporation (PSMC) rose to eighth place due to the recovery of dedicated DRAM wafer starts and urgent orders for smartphone components.

Secondly, Hefei Nexchip re-entered the top ten list at ninth place, driven by urgent orders for TDDI (Touch and Display Driver Integration) and new product launches for CIS image sensors.

Lastly, Vanguard International Semiconductor (VIS) fell to tenth place due to a slowdown in TV-related inventory stocking and inventory adjustments among automotive/industrial control customers.