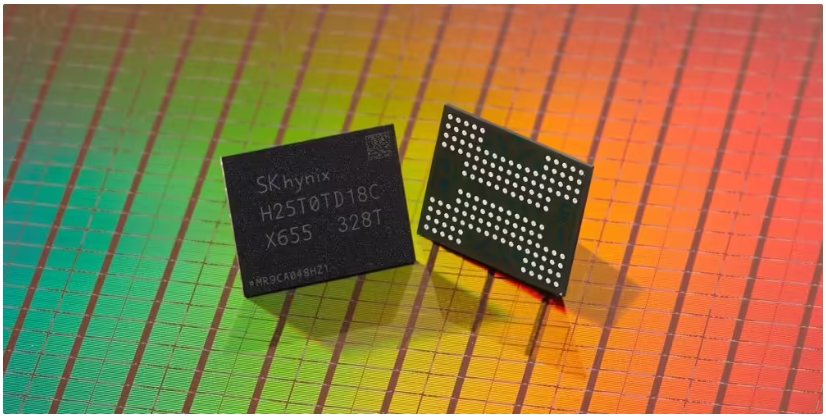

January 20, 2026 – According to a report by South Korean media outlet ChosunBiz today, based on data from Omdia, two major NAND flash memory manufacturers, Samsung Electronics and SK Hynix, which together account for over 60% of global NAND production capacity, are set to reduce their wafer starts for flash memory this year. This move is likely to further exacerbate the existing shortage of NAND supply in the market.

It has been learned that Samsung Electronics plans to invest a cumulative total of 4.68 million NAND wafers this year, compared to 4.9 million wafers in 2025. SK Hynix, on the other hand, aims for a production capacity of 1.7 million wafers this year, down from 1.9 million wafers in 2025. The combined production capacity of the two companies is expected to decline by approximately 6.2% year-on-year this year.

In stark contrast, the demand for NAND flash memory in AI infrastructure construction continues to soar year after year. According to data from Citi, Nvidia’s Vera Rubin superchip rack system requires a staggering 1,152TB of solid-state drives (SSDs), which is more than ten times the capacity required by its previous-generation Grace Blackwell system.

Given the significant losses they incurred during the previous storage cycle, both Samsung Electronics and SK Hynix are currently pursuing a “profit maximization” strategy in the NAND sector. As a result, there is little incentive for them to substantially increase their flash memory production capacity at this time.