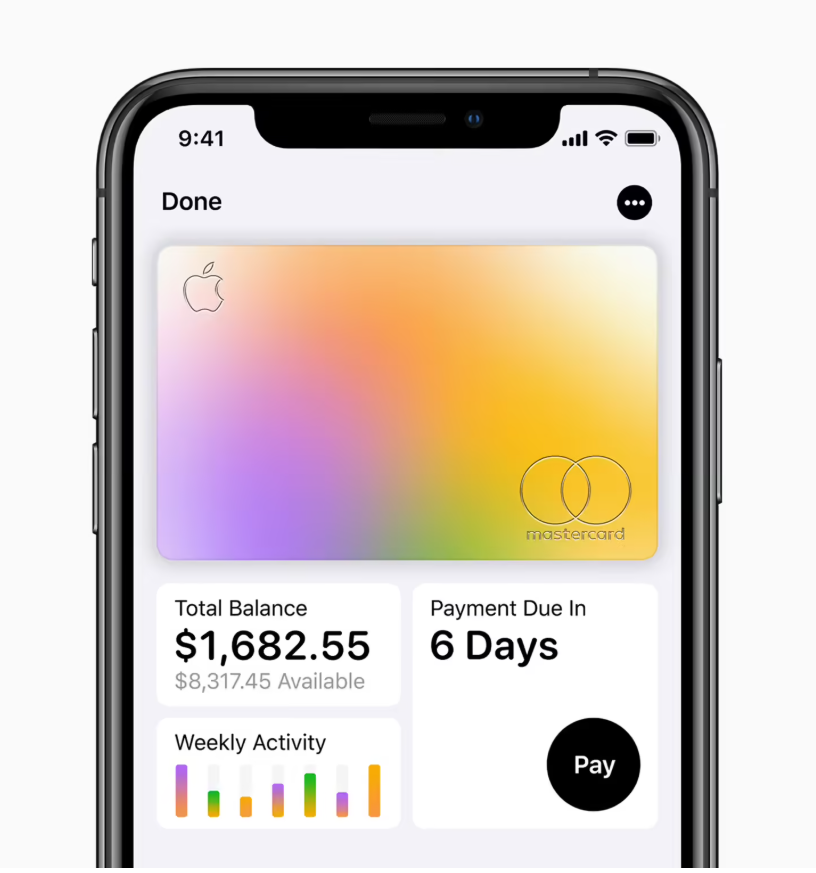

July 30, 2025 – According to a report by The Wall Street Journal yesterday, Apple is in discussions with JPMorgan Chase to take over the Apple Card credit card business from Goldman Sachs.

The negotiations between Apple and JPMorgan Chase reportedly started early last year, but the pace has picked up significantly in recent months. Anonymous sources revealed that Apple has informed JPMorgan Chase that it is the “preferred candidate to replace Goldman Sachs as the Apple Card partner.”

At present, no formal agreement has been signed between Apple and JPMorgan Chase. The existing cooperation deal between Apple and Goldman Sachs for the Apple Card is theoretically set to run until 2030. However, Goldman Sachs CEO David Solomon has previously hinted that the agreement might end earlier than planned.

Goldman Sachs is currently grappling with escalating financial losses, which have forced it to restructure its consumer finance business. This restructuring is likely aimed at terminating the Apple Card cooperation agreement ahead of schedule.

Nevertheless, sources also pointed out that the potential partnership between Apple and JPMorgan Chase could face some hurdles. One of the key issues is the Apple Card savings account, a high – yield savings account exclusively available to Apple Card users. JPMorgan Chase currently does not offer a high – yield savings account product, while Goldman Sachs still operates a high – yield savings account called Marcus. As a result, it is highly likely that while the operation of the Apple Card credit card may shift to JPMorgan Chase, the savings account part could continue to be supported by Goldman Sachs.

In addition, the Apple Card credit card could undergo significant changes once it is transferred to JPMorgan Chase. Currently, the Apple Card does not charge any fees other than interest, offers up to 3% cash back on purchases, and provides interest – free installment plans for Apple product purchases. To attract a new partner, Apple may cut some of these Apple Card benefits.

Prior to its talks with JPMorgan Chase, Apple has also held discussions with other credit card issuers such as American Express, Capital One, and Synchrony regarding the Apple Card cooperation. However, as of now, JPMorgan Chase seems to be the most likely contender to take over the business.