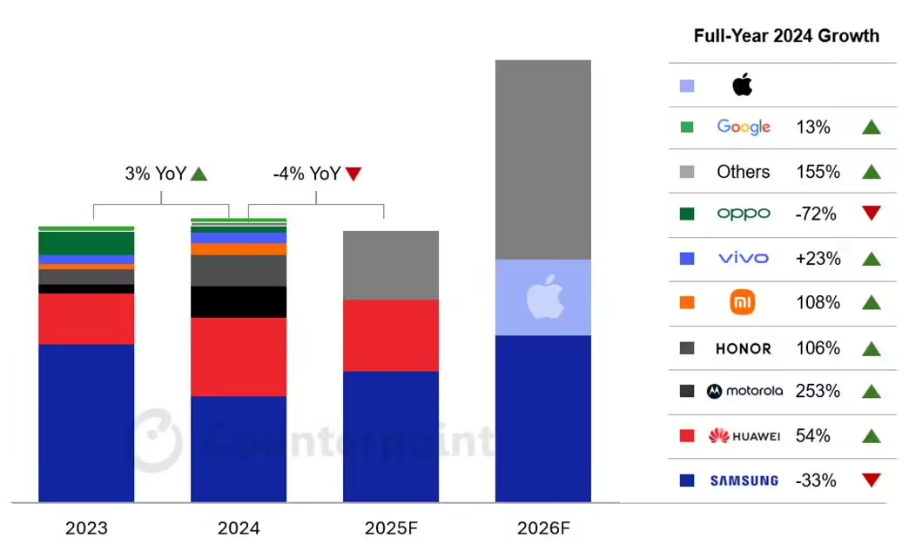

April 1, 2025 – The market research firm CounterPoint Research released a blog post on March 28th, revealing that the global foldable smartphone market experienced a mere 2.9% growth in 2024, marking a significant deceleration. The report further projects that the market will witness its first single-digit negative growth in 2025 but anticipates a robust rebound in 2026, fueled by Apple’s entry into the segment and a resurgence of small foldable devices.

According to CounterPoint Research’s latest findings, global foldable smartphone shipments in 2024 grew by just 2.9% year-on-year, indicating sluggish expansion. Despite double-digit or even triple-digit growth achieved by several manufacturers, a sharp decline in Samsung’s fourth-quarter sales and OPPO’s reduction in production of low-cost clamshell foldables significantly impacted the overall market performance. In contrast, Huawei, Motorola, Honor, and Xiaomi reported double-digit growth rates.

CounterPoint’s report on 2024 global foldable phone shipments shows contrasting fortunes: Samsung saw a 33% year-on-year decline, while Huawei grew by 54%, Motorola by 253%, Honor by 106%, Xiaomi by 108%, vivo by 23%, and OPPO experienced a steep drop of 72%.

Looking ahead, CounterPoint predicts that the foldable smartphone market will face even steeper challenges in 2025, potentially posting its first single-digit negative growth. Senior Analyst Jene Park commented, “This year, the market lacks standout highlights, and negative growth will emerge for the first time. However, this is not a sign of market saturation but rather a setup for an explosion in 2026. With Apple’s entry and the return of clamshell models, the market could achieve double-digit growth in 2026.”

CounterPoint’s report also indicates that foldable display panel procurements are estimated to increase by more than double digits year-on-year in 2026. Research Director Calvin Lee noted, “Supply chain feedback suggests that foldable orders are being scheduled far into the future. The current market is not stagnant but stands at the eve of a transformation.” Manufacturers need to prepare ahead, leading to a temporary market correction in 2025.